TRANSLATE THIS ARTICLE

Integral World: Exploring Theories of Everything

An independent forum for a critical discussion of the integral philosophy of Ken Wilber

Knut K. Wimberger helps executive management with organizational development challenges in a Far East Asian context and supports key individuals to unfold their potential. He believes in the healing force of finding one’s vocation and is driven by giving others deeper meaning in their work. He founded the Hong Kong incorporated consultancy Telos Pi in 2016 and acts as its managing partner. A public CV is available on LinkedIn.

What it Takes to Establish an Integral Currency

Why Bitcoin is Both a Risk for Doom

and an Opportunity for Transformation

Knut K. Wimberger

… when advancing science and technology alter man's long-established relationship with the planet on which he lives, revolutionize his societies, and at the same time equip his rulers with new and immensely more powerful instruments of domination, what ought we to do? What can we do? [Aldous Huxley]

All currencies that humanity has seen so far have created abundance for a few and scarcity for the majority.

Shenzhen, 18. January, 2018. As I enter the arrival hall in Baoan Airport my eyes search for Vasily in vain. He is not here. I give him a call and he picks up the phone. “I am on my way. You told me that you would arrive a quarter to eight.” I sit down in a Costa Coffee next to the arrival exit and wait for him. Vasily shows up ten minutes later and sits down opposite of me. I notice that he is taller than in my memory; probably 1.90, slim, dressed in black jeans and a black denim shirt, a grey scarf tied around his neck. If there weren't teenager bracelets on his teeth, he would go through a Russian spy in a James Bond movie.

Vasily is actually from the Ukraine and I met him only two weeks earlier on a Shanghai event, where I spoke about the future of work and the impact of robotics and AI. He approached me after the event and explained that he owns a trading company, which buys mining rigs in Shenzhen and sells them to Eastern Europe, Russia and the US. As the conversation unfolds, he provides incredible numbers about the hardware industry behind the Bitcoin hype, and I am hooked. Mining rigs | 挖矿机. What in God's name is he talking about? Aren't rigs infrastructure to drill for oil?

I had a few years ago, when I first heard about Bitcoin and cryptocurrencies, opened a mental drawer and put the entire subject ad acta: pyramid scheme. Those who come first earn massive profits, those who come last bear the risk. Recently, the blockchain technology behind Bitcoin has attracted my interest after reading Heinz von Förster and Bernhard Pörksen's conversation on Understanding Systems. Förster, who had the nickname Socrates of Cybernetics, explains therein the concept of circularity and I immediately understood that blockchain indeed is the technology to put in reality what the participants of the Macy Conferences have probably envisioned for humanity back in the 1950s: meritocracy.

Vasily is from Kiev, studied Chinese and worked as a translator for heavy and military industry companies which sell their products to China. He did, as a matter of fact, also support the sales of huge excavators, the kind of which is used in large surface mines. He tells me with an air of genuine astonishment, that his old clients always wanted to know every detail of the machine they were about to purchase; but not his new clients. They ask no questions and pay up to USD 6000 for a single rig. Only seven months ago he left the physical mining industry for the digital one. My facial expression must have given away my disbelief, because he pulls out his mobile and shows me pictures of machines which look a bit like chunky early desktop computers without monitor.

My new technical advisor explains that mining rigs are supercomputers which contain between 170 and 200 chips, each one of them capable to operate a high-end laptop. Once they are launched, they perform the complex calculations which are required to mine for Bitcoins. A crash course for those who know even less than me about Bitcoin: the digital currency was launched in 2009 and is created as a reward for a so-called proof of work, i.e. solving hyper complex calculations with a computer. The currency operates with blockchain technology, which is characterized by being decentralized and encrypted.

Now, I originally liked that idea and the timing couldn't have been better. With the GFC in full swing, the mysterious Bitcoin founders who are known under the pseudonym Satoshi Nakamoto definitely felt the pulse of an era which is characterized by faltering economies, decadent capitalism, corrupt governments and banks which are too big to fail. They established with Bitcoin in a revolutionary hacker act a currency which is not controlled by a central bank and can't be manipulated by Lehman Brothers & Co. So far so good.

Humanity's Challenges Mirrored In Bitcoin

- Scarcity and exclusion vs abundance and inclusion

- Environmental degradation vs ecological conservation

- Greed vs kindness

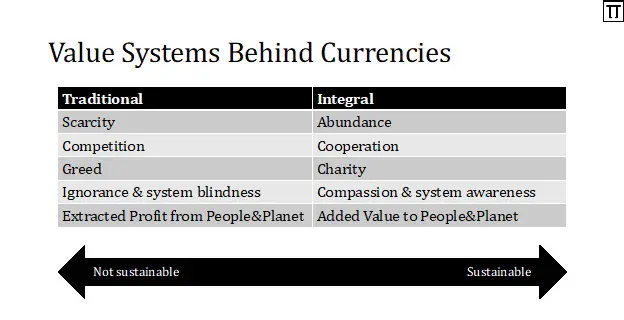

The problem with Bitcoin and as far as I can tell with all cryptocurrencies is that it operates apart from decentralization and fraud security along the same lines as all fiat currencies do: Bitcoin establishes a financial system of scarcity which gives preferred access to tech-savvy instead of finance-savvy people—or even worse: a combination of the two - and leaves most of humanity to its own terms. It is a financial system which is driven by greed instead of charity and it rewards futile mining with profit instead of motivating man to do good at his neighbor or the environment. Researchers at Cornell have recently confirmed this assumption by showing that Bitcoin and Ethereum mining is very centralized, with the top four miners in Bitcoin and the top three miners in Ethereum controlling more than 50% of the hash rate and the entire blockchain for both systems is determined by fewer than 20 mining entities.

Speaking of the environment, there is a third downside to Bitcoin which is widely discussed in “green” circles lately, at least since the World Economic Forum posted a short clip explaining that Bitcoin mining consumed at the end of 2017 every day as much electricity as Ireland and Nigeria together and will by 2020 consume more electricity than the entire world. Well, that's some exponential growth supercharged by nihilist greed. More for me at the expense of the planet and anyway, fuck you all.

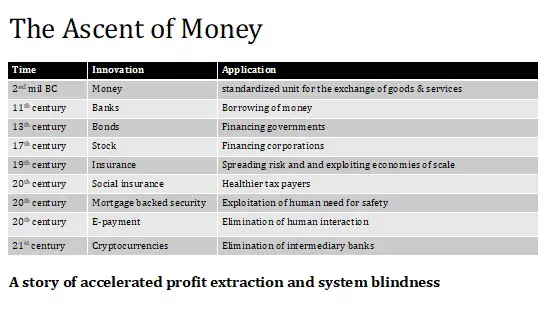

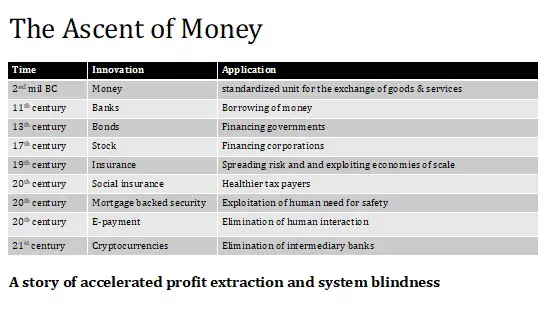

The Ascent of Money

Despite only 3-5 million Bitcoin users, only about 120.000 shops which accept Bitcoin as payment and 0.2% electricity consumption of the total global volume, we need to recognize that Bitcoin is an important invention in the history of finance, which will change things forever. Historian Neil Ferguson summarized in 2008 the milestones of financial innovation and made it clear that innovation is not limited to technology and science, but extends deeply into the realm of money. It is the confluence of science, technology and finance that creates the most powerful social change maker; for better or worse.

Humanity uses money since about four millennia and as much as one wants to stigmatize this invention as a devil's deed, money is very much like technology nothing more than a mean to an end. The problem for many people is the sheer fact that they confuse the mean with the end and get stuck in a mindset which declares money either Satan or God. Ferguson writes that it is as a matter of fact only a medium of exchange, which has the advantage of eliminating inefficiencies of barter; a unit of account, which facilitates valuation and calculation; and a store of value, which allows economic transactions to be conducted over long periods as well as geographical distances.

Ferguson recounts that with money came borrowing and lending, which was in the Italian city states as early as the 11th century institutionalized in banks. Governments started to issue bonds in the 13th century to finance wars and other major investments. Corporations followed that model by issuing stock from the 15th century onwards. The 19th century introduced the private insurance as a vehicle to spread risk. Governments reinvented this concept in the 20th century to increase the health of their taxpayers through social security. The 20th century saw an exponential growth in financial innovation and introduced mortgage backed securities, which exploit the human need for safety and render the concept of property ownership ad absurdum. The collateralized mortgage obligation was the cradle for other such neo-mercantilist innovations like derivatives, futures and options, all of which contributing to the subprime housing crises and eventually to the 2009 GFC.

Historian Yuval Harari did point out in Sapiens—A Brief History of Mankind that money had an enormously unifying effect on humanity, which by far outpaced the two other contenders for bringing unity to our species: religion and empires. Money must also be considered as being most conducive to the development of written language since the earliest remains of human writing are Sumerian accounting books dating back three millennia BC. We clearly must acknowledge that there wouldn't have been any progress in our civilizations without financial innovations, but we also must understand that the story of money comes with a narrative of profit extraction and system blindness, that is, a story of human virtue and vice.

US Capitalism on Chinese Steroids

Vasily and me ride an illegal cab from the airport 20km north, where the mining rig warehouse is located. We pass a huge building with neon lit letters saying 深圳西硅谷 | Shenzhen West Silicon Valley. There is no doubt about this city's aspirations. I recall a recent chat with an Apple engineer who flies once a quarter to Shenzhen to check the production quality of California designed products. Many engineers lament that manufacturing has moved to China and are full of envy about the high concentration of hardware production facilities in Shenzhen.

The city, which was basically founded in 1992, when Deng Xiaoping undertook his famous journey south to open in Shenzhen the first special economic zone (SEZ) is as of today only second to Beijing in the number of resident billionaires. In particular real estate tycoons—which according to Hurun make up for about 2/3 of China's wealth and high-tech entrepreneurs have chosen safe distance from the capital and vicinity with the established trade and finance center Hong Kong. Global giants like Vanke, BYD, Tencent, Huawei, ZTE and rising tech stars like Megmeet or Bitmain call the city their headquarter.

Bloomberg reports that many Chinese Silicon Valley employees flock recently back to this place despite not even in the furthest resembling any part of California. Shenzhen is about to merge with Hong Kong, Guangzhou and other cities in the Pearl River Delta and the region is expected to turn by 2030 into the world's largest metropolitan area with about 120 million inhabitants. Population density, thick smog and industrial pollution can't be the pull for these sea turtles to return to their hatching beaches.

There are few things less pleasing to the Lord, and less productive, than an engineering department that rapidly turns out beautiful blueprints for the wrong product. [Peter F. Drucker, Management Philosopher]

Vasily tells me that he was in Bitmain's Shenzhen offices only this week to negotiate about a larger mining rig order. Stock is currently difficult to come by at Bitmain and only direct purchase from the manufacturer guarantees good margins. He asked for 1000 pcs of ant miner S9 13.5T, Bitmain's newest mining rig, which will soon be substituted by the S9 14T model. Bitmain told him that the maximum order he could place after Chinese New Year were 400 pcs and that the price would be USD 2400 each. He would be able to pick up his batch mid-April implying a lead time of roughly two months and prepayment.

Since I don't understand the craze about Bitmain, Vasily tells me a bit more about the company background. Founded only in 2013 by former financial analyst Wu Jianhan and tech media entrepreneur Zhan Micree, the company has since then embarked on a steroid charged growth and innovation trajectory. Headquartered in Beijing as 比特币大陆科技有限公司, literally translated Bitcoin Mainland Ltd., its name does indicate their founders' mission: to develop a Chinese substitute for Bitcoin or displace it altogether.

Despite this techno-nationalistic ambition, Bitmain has lately run into problems with Beijing, because its activities have increasingly threatened the stability of the Chinese Yuan. It is mainly due to Bitmain's role as leading manufacturer of Bitcoin mining rigs, its vast investment in mining farms and Chinese investor's rush on cryptocurrencies as alternatives to the rigid domestic financial system, that initial coin offerings (ICO) have been declared illegal in mainland China. Since mining farms have also come under more scrutiny, Bitmain considers to shift parts of its business model and looks for B2G partnerships, i.e. governments which are willing to enter long term agreements and can provide cheap electricity.

Vasily believes in Bitmain's short term success and has also started to think about establishing mining farms in other countries. He tells me that he and his US business partner have founded Cryptocurrency Mining Inc. (CMI) in Virginia State and have sold up till now roughly 700 rigs to clients in Ukraine, Russia and US of America. They have made friends with a sales manager at Bitcoin who moves them on the waiting list forward in exchange for a commission to cut the intermediary margin. Purchasing from Bitmain directly is difficult and most batches are sold out long before they are manufactured. While latest models cost at Bitmain around USD 2000, they are resold by 1st tier traders for around USD 4000 and get to the end customer for more than USD 5000. “Margins are just phenomenal,” Vasily says.

Our cab stops opposite of Tianhong Mall at Kaijia Hotel, both buildings lit with neon and towering a dozen floors over a large intersection. A short Chinese, dressed completely in black, military hair cut, opens the car door and throws a few words Russian at me. We walk into the hotel lobby and while the staff copies our passports, I realize that we are in the midst of negotiations. Vasily asks for the current price. Lao Wang types 27000 into his iphone. He divides by 6.4, shows Vasily 4218 and adds “美金| USD.” Vasily in turn calls a friend to confirm the price from another retailer and comes back to the conversation with a new number: 25500. I am losing my patience with the hotel staff, so does Vasily's friend, “Impossible” he says, typing 26500 into his phone. “This is my last price. How many do you want to buy anyway?”

We queue up for the elevator with four young women and ride up to the third floor. The female hotel attendant who takes us to our rooms smiles at us when the women get out of the elevator and smiles awkwardly, “We have a KTV on 2nd and 3rd floor. Your rooms might be a bit noisy.” Her warning turns out to be true and I am wake until 2am despite ear plugs listening to the disharmonic vocals of drunk men. We leave our rooms though immediately after dropping off our luggage and head out to see the mining rig distributors.

We leave the hotel through its back entrance, which also serves as the night club's main entrance and walk only 100 meters to the next block of buildings. Innovative company names expect us there, generally inducing a sense of industry and confidence: Honey Bee Technology |蜜蜂科技, Guangxi China Technology Ltd. |桂华科技有限公司, Dragon God Excavators |神龙矿机, Yutong Mining Corp. | 禹彤矿业, Profound Trust Mining Corp. |伟信矿业. The creators of Yutong Mining Corp. must have brooded substantially about how to call their enterprise and I am intrigued how Chinese entrepreneurs quite often manage to claim the past of their ancient culture. Yutong was the mythical founder of the Xia Dynasty which reigned over the cradle of Chinese civilization between the 21st and 16th century BC. He is also nicknamed as the tamer of the floods. We will see if the current ruler of this country will be able to tame the floods unleashed by this industry.

A Dexun | 德讯物流 packaging station is perched in between the distributor offices and about two dozen men are busy moving palettes of mining rigs from one place to another, preparing the packages for their final destinations. I take a closer look at the delivery notes and read 29 pieces to Shanxi, 32 pieces to Xinjiang. “Why do most of these deliveries stay in China? I thought mining is no anymore allowed.” Vasily pulls me away and takes me to Yutong Mining Corp., where he waves to a young fellow inside the office. The young, tall man with blonde hair introduces himself as Sasha. Dressed in super slim jeans and a wide Moschino T-Shirt, probably in his early 20s, he is not really a match for this industry, but he turns out to know or at least talk a lot.

Sasha has been living in China for 10 years, most of the time in Shenzhen, and now works as a Russian-Chinese translator for Yutong. His boss is a Shanxi business woman who operates both a distributor network for mining rigs as well as mining farms in Shanxi and Xinjiang. Sasha is clearly part of this gold rush. He skips from one leg to another and tells us that he hardly sleeps, maybe two or three hours a night. He stays here every evening until 11 pm and thinks that he suffers from insomnia. “I am ok though,” he adds, “its exciting.” He explains that Dexun has set up shop here to ship mining rigs throughout the country and beyond, since most manufacturers are based in Shenzhen and a large fraction of the production volume goes through the dealers on site.

“This morning we sold the S9 13.5 model for 23500, but this evening it was 27000,” Sasha's eyes are shining and he smiles broadly. The hardware behind the entire mining craze is tightly linked to the value fluctuations of the cryptocurrency. “Sure, you can also buy second hand rigs. We just got a batch of 400 returned from a Xinjiang business man. He thinks that operating a farm is too dangerous with the government increasing electricity prices and potentially shutting down operations. In such a situation, you can get rigs much cheaper.”

I ask Sasha why most of the Dexun deliveries still go to Chinese recipients when it is illegal to run farms. He replies that “It's a shame that the government tries to destroy such a profitable industry,” and explains that there is always the possibility to strike a deal with local governments and continue farming operations. “Although such huge power consumers must be easy to locate?” I want to know. Sasha shows that he has assimilated himself to skirting regulations and understands the complex dynamics of multiple interests in Chinese society. “You see, for the government and the State Grid (the state-owned electricity supplier) it's a great business to have stable and large consumers and they would like to continue cooperation; many local governments do also harvest tax revenue in remote locations. They naturally want the farms to continue operation.”

On our way back to the hotel a shiver runs down my back as I realize that I just discussed the manufacturing industry behind one of the milestones in financial innovation with two Caucasian men in Chinese, not in English. A clear sign of where power converges in the 21st century at the intersection with science and technology. The nightclub is in full swing, barflies queuing at the elevator and deafening Karaoke singing already penetrating the lobby, and I continue to chat with Vasily about the implications of Bitcoin mining for the Chinese government. Why were ICOs declared illegal in 2017? Cryptocurrencies do not only corrupt the USD, but all national and centrally controlled currencies.

Bitcoin is thus a threat for all governments and its growth in value increases not only the USD but also the CNY inflation. But if Beijing were really concerned about the CNY being corrupted by Bitcoin banning farms from its territory doesn't seem to be the decisive blow required to stabilize its own currency. It would have to shut down the manufacturers of mining rigs and could do so, because 90% of them are located on its territory. Antminer | 蚂蚁Divine Horse | 神马, Avalong | 阿瓦隆, Chipmover | 芯动科技, Wingbit | 翼比特 The industry leaders are all Chinese. So, why is it holding back a lethal strike?

Its seems like Beijing is in a dilemma. There are high tech companies, which create jobs and add value to the economy, but indirectly sabotage the national currency. On top of that companies like Bitmain are rising stars in artificial intelligence research, one if not the most strategic industry Beijing wants to dominate. Vasily believes that the company has a vision which goes far beyond Bitcoin. The revenue made with the sales of mining rigs is reinvested in the development of Sophon, a new generation of microchip, which is according to the company founders supposed to power AI towards singularity.

Wired published about a year ago a piece about where Zhan Micree's inspiration for Sophon came from: science fiction author Liu Cixin calls a proton sized microprocessor Sophon. It is spread on Earth by hostile aliens in his novel The Three Body Problem. Bitmain is also active in robotics—or should I rather say education - and has recently presented Luo Xiaodou. This small robot which resembles Eve from Pixar's Wall-E is designed to support children in their learning progress. I won't go here into details, but ask any developmental psychologist, kindergarten or primary school teacher and they will all tell you that children learn best with humans, not robots. One is left with a foul taste about all Bitmain activities and must wonder: which end justifies these means?

Vasily also confides to me his conspiracy theory, but only after he admits that he thought that I am Australian. Now that he knows that I am from this beautiful country which is home to Steyr rifles, “True works of art” he marvels, and Alfred Adler's individual psychotherapy, he expounds his theory about mining rigs being remotely controlled and Bitmain trying to build a global supercomputer. I give the idea some thoughts and swiftly have Matrix-like visions in my head. What if the mining rigs could really be controlled through the web and what if Bitmain will launch Sophon to take over their collective processing power? What would that mean for humanity?

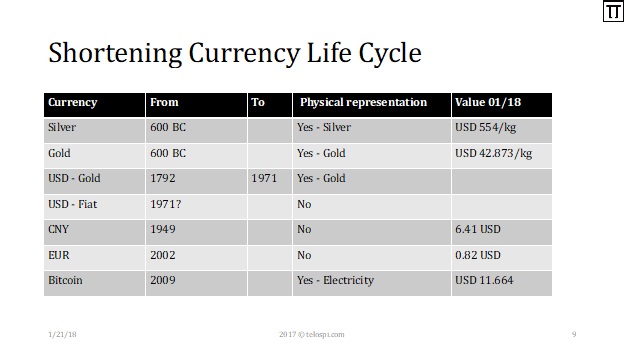

Accelerated Currency Life Cycles

Bitcoin sadly repeats a broken system. It makes those who have access to it wealthy, those who don't are left behind.

I don't arrive though at dooms day science fiction scenarios of either the Chinese government taking over the world through Bitmain nor aliens usurping our planet. Quite on the contrary, I start to think again about currency life cycles and financial innovation and what Thomas Hobbes meant when he used in Leviathan the much older proverb homo homini lupus. Humankind doesn't need hostile aliens, because it excels at destroying itself. One really has to spend a few thoughts on the monetary system to understand what digital currencies have kicked off and what our greed driven race towards singularity implies.

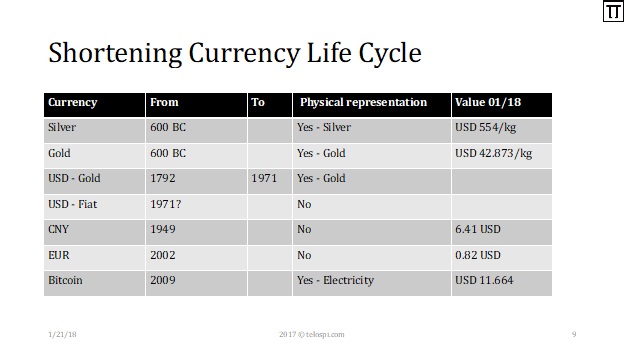

The US Dollar, which is still the most dominant global currency, has been in use since its inception in 1792, but was 1971 decoupled from gold and is since then fiat currency, i.e. a value we believe in and which has no representation in the physical world. One could argue now whether the USD has had a hitherto life span of roughly 230 or 45 years, but one would always come to the conclusion that not only the USD, but all fiat currencies are subject to a life cycle of birth and death. Why is that?

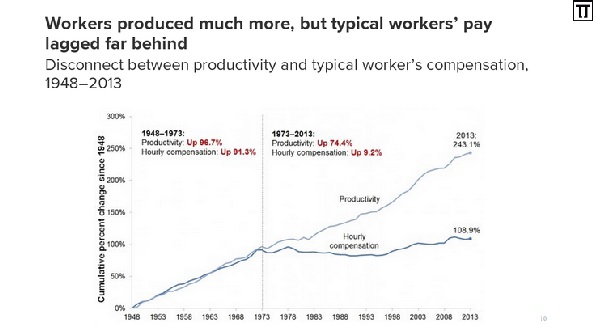

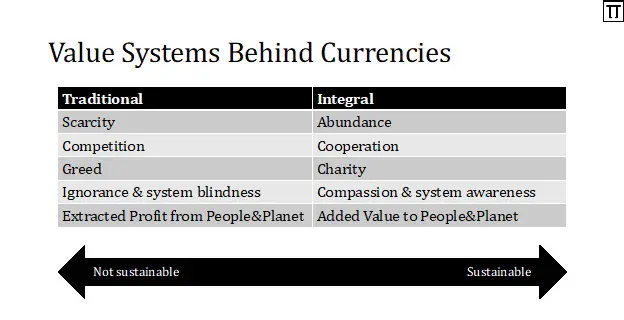

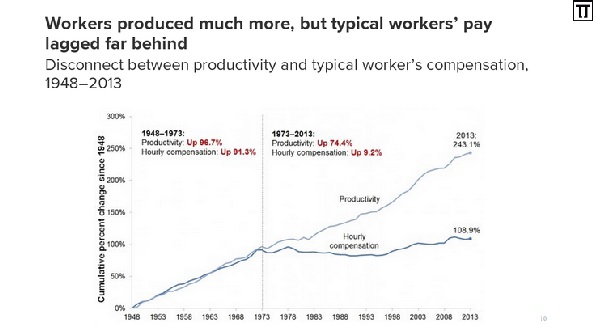

This statement is grounded on three simple observations. Firstly, all currencies that humanity has seen so far have created abundance for a few and scarcity for the majority; they are as such an exchange mechanism which gradually leads to more wealth inequality, because they enable the ruling classes to extract profit at the expense of the working class (human resources) and the planet (natural resources). French economist Thomas Piketty and his research team have partly explained this gradual inequality increase in Capital in the 21st Century with the formula r > g, i.e. if return on capital is higher than economic growth, then inequality rises. Piketty proposes a global system of progressive wealth taxes to help reduce inequality and avoid the vast majority of wealth coming under the control of a tiny minority.

I do not agree with his solution to the problem, because it is a superficial one, which does not address the other two observations: gradual inflation and the value system behind currencies. All currencies loose in value over the course of time until they are rendered almost valueless at the expense of those who sell their workforce instead of having been able to acquire physical wealth, that is real estate. Cryptocurrencies are not an exception to this rule as the future will show despite the gold rush on Bitcoin, which essentially gives profits to those who can generate electricity cheapest. They will follow the trajectory of the USD at a much faster pace and thus confirm that all currencies which create scarcity have only a limited lifespan. In the case of the USD inflation between 1981 and 2009 was 50%; and it lost 2/3 of its value between 1961 and 1981. What does this mean exactly?

It means that somebody who inherited land from her parents in 1981 worth USD 100k added USD 100k nominal net worth—not taking into account other factors contributing to real estate price fluctuations. Somebody who earned 1981 USD 100k a year would have to make USD 200k payroll as of 2009 to be able to afford the same things he was back in 1981. Statistical records show though that wages have not increased in purchasing power parity, but quite on the contrary melted like the Arctic ice shield under climate change.

The Economic Policy Institute (EPI) writes: Ignored is the easy-to-understand root of rising income inequality, slow living-standards growth, and a host of other key economic challenges: the near stagnation of hourly wage growth for the vast majority of American workers over the past generation. […] Slow and unequal wage growth in recent decades stems from a growing wedge between overall productivity—the improvements in the amount of goods and services produced per hour worked—and the pay (wages and benefits) received by a typical worker. In other words, the American elite has kept within its nation most of the productivity gains for itself instead of sharing with society at large; and has done so even more with respect to the ROW. It is in particular China which follows this American concept, despite being at least since a century undetermined whether it should befriend and imitate or hate and destroy its Pacific adversary.

Bitcoin sadly repeats a broken system. It makes those who have access to it wealthy, those who don't are left behind and all this happens at an enormous ecological cost, confirming once more that social and environmental problems are intrinsically connected with each other. Niall Ferguson came to a similar conclusion when he wrote in The Ascent of Money on the origins and effects of hedging: The fact nevertheless remains that this financial revolution has effectively divided the world in two: those who are (or can be) hedged, and those who are not (or cannot be). You need money to be hedged. What has changed though is the currency life cycle duration. While national fiat currencies might have lasted centuries or decades, Bitcoin won't last that long because it has reintroduced a physical representation which makes it impossible to not recognize the exploitation of related resources.

Silver and gold were the most widely used natural resources which were minted into coins since 600 BC. The scarcity of the metals was represented in their value as payment and so was the value of our currencies by their representation in the metals. It was the year 1971, when we basically lost the direct connection between our currencies and their physical representation. The USD was decoupled from gold and all countries on this planet followed en suite, Switzerland being the last country to decouple from gold only in 1999. The results can't be more highlighted: we have lost our framework of reference for what we extract from the planet. This observation is most poignantly put into words by economist E.F. Schumacher who wrote only two years later in Small is Beautiful: Economics as if People Mattered:

The illusion of unlimited powers, nourished by astonishing scientific and technological achievements, has produced the concurrent illusion of having solved the problem of production. The latter illusion is based on the failure to distinguish between income and capital where this distinction matters most. Every economist and businessman is familiar with the distinction, and applies it conscientiously and with considerable subtlety to all economic affairs—except where it really matters: namely, the irreplaceable capital which man has not made, but simply found, and without which he can do nothing. […]

A businessman would not consider a firm to have solved its problems of production and to have achieved viability if he saw that it was rapidly consuming its capital. How, then, could we overlook this vital fact when it comes to that very big firm, the economy of Spaceship Earth and, in particular, the economies of its rich passengers? One reason for overlooking this vital fact is that we are estranged from reality and inclined to treat as valueless everything that we have not made ourselves.

Bitcoin has stepped up the exploitation of natural resources and accelerates this process by the day. But it has reintroduced a commodity representation since its value is pegged to the price of electricity, which like gold or silver is a physical commodity. We will therefore again see directly—not only indirectly - what has been hidden from us for almost 50 years: that an economic system, no matter by which currency it is represented, which is based on scarcity, profit extraction, ignorance and competition will eventually lead to environmental degradation and social dissolution.

Three Reasons Why Bitcoin Won't Last

Now, there are three reasons, why I believe that Bitcoin will be gone in latest three years from now. Firstly, it is not in the interest of the Chinese government to let Bitcoin grow into a genuine rival to its own currency. Here I add my own political conspiracy theory, because after all what I have seen down here in Shenzhen, it is more than plausible that Beijing plays for time, assuming that the already shaken US economy will falter and crash earlier than its own under the pressure of the crypto currency rush. Despite considering to ban mining farms and having declared ICOs illegal last September there are no changes in sales, delivery and operation of mining rigs.

We all know that Chinese authorities are capable of executing top down policies sharply if they really want to. But this policy doesn't seem to be an executive priority. Harbin born Liu Yan, owner of Yutong Mining Corp., tells me that there are no restrictions whatsoever. Bitmain's monthly production volume stands at 70.000 mining rigs and they are shipping to buyers all over the country. The manager at Dexun logistics explains that his company alone delivers around 10.000 Bitmain products—not limited to mining rigs—a day. It doesn't seem that Beijing has made a move yet, but surely will once its objective is reached. We witness a financial cyber war which is fueled by both greed for power and fear of losing it.

Secondly, China and the rest of the world can't afford to turn a blind eye to the enormous energy consumption for both transactions and mining. Quartz reports that cheap electricity is a major advantage for bitcoin miners in China. Coal-abundant regions such as Xinjiang and Inner Mongolia have in recent years taken to crypto mining as a niche approach to transforming their less-developed economies. Bitmain has taken advantage of cheap coal-fired power in those two regions to build several of the world's largest mining facilities. In Inner Mongolia's Ordos city, local authorities offer the company a subsidized electricity rate of just 4 US cents per kilowatt hour. That's 30% cheaper than what industrial firms in the area typically pay, and well below prices in the US and most European Union countries [of 13 US cent and more].

The flourishing of China's digital mining industry accounting for 2/3 of the global volume can be also understood as a result of a system failure, i.e. a highly centralized power generation which fails to produce close to the consumers. Again Quartz: The massive hydropower networks in Sichuan and Yunnan were built to transfer electricity to the rest of the country, but state-run grid operators too often fail to prioritize renewable energy over coal. In 2016, Yunnan wasted a staggering 32 billion kWh (link in Chinese) of hydropower, about equal to the total electricity consumption of Denmark the same year.

But even if the consumption of fossil fuels for mining is eliminated and a shift to renewables is successful as hydropower, geothermal and solar farms in Austria, Iceland and the US show, there remain important questions to answer: why should we anyway consume huge amounts of electricity to solve theoretical calculations? What productivity gain do we actually generate for society thereby? Don't we suffer from enormous system blindness if we can't come up with another proof of work concept? A proof of work performed by a machine which you just plug into the grid seems to be no proof at all. Why should the owner of that machine retrieve any reward in the first place? Isn't it a perverted concept to engage machines to create “fiat profit” when actually only excess consumption which translates to destruction of natural resources takes place in its purest form, that is energy? Why aren't we able to create a currency which rewards value added to society, that is a productive benefit to people or planet, which does not come at the expense of one another?

And this leads to the third reason for Bitcoin's early demise: advancing computing power and eventually singularity. Some people believe that singularity is still far out in space and time. Some don't even know what the concept entails. But we can certainly assume that research into deep learning microchips by companies like Bitmain or Intel will further speed up computing power. While most computers still operate with a Central Processing Units (CPU), mining rigs and state of the art deep learning machines use Graphic Processing Units (GPU). Both Bitmain's Sophon and Intels Neuromorphic Processing Unit (NPU) will be able to perform calculations beyond the digital zero & one elements and open the door into the era of quantum computing.

Such exponential acceleration of computing power can only lead to two outcomes I reckon. One is a singularity which is able to solve all calculations in no time, bringing the Bitcoin system to a sudden crash, because the competition between computing units to add new blocks to the chain is eliminated. This is in particular interesting, if we assume that singularity entails a self-conscious collective network of existing computing power as opposed to one which my friend Vasily envisioned as being remotely controlled by companies like Bitmain.

Two is an ever-accelerating system of calculations which can be only compared to Pandora's box, which mankind opened to devour this planet. The Verge writes that some cryptocurrency entrepreneurs believe that the switch to green mining sectors is bound to happen. But even if it does, it's unlikely to take place right away. Fossil fuels will remain cheap for the foreseeable future, and better renewable technologies take time to develop. Until then, it's a matter of what society values the most: an alternative currency that may give people freedom from big banks—or less charitably, wild profits on currency speculation at the expense of the environment. In other words, it's a matter of what humankind is motivated by: greed or compassion for the environment.

Modern man does not experience himself as a part of nature but as an outside force destined to dominate and conquer it. He even talks of a battle with nature, forgetting that, if he won the battle, he would find himself on the losing side. [E.F. Schumacher]

The underlying system is thus much larger than just a transformation of the energy sector from fossil fuel based to renewables. The energy sector does though like nothing else on this planet reflect humankind's value system: a distributed and global network of sharing or isolated patches of inefficient generation and wasteful consumption. Competition based incentives inevitably move towards centralization and the formation of oligopolies or worse, a monopoly. This is clearly visible in China's long term plans for its own energy infrastructure which rely heavily on centralized and independent nuclear power. Bitcoin is a resource (energy) token, but it also requires that you create more of the resource to be able to mine the token. One observer wrote that it resembles an energy virus with a built-in dopamine reward for its hosts based on how much energy they feed it.

The virus is though clearly in the mindset and value system of Bitcoin users. If we continue, the entire output of human activity will concentrate on building energy farms to feed bitcoin. A trajectory which defeats the purpose of having more renewable energy with which we try to replace fossil fuel based energy sources. A trajectory which plays though into the hands of governments like China which want to create national cryptocurrencies that are fueled by infinite nuclear power. Such a crypto-CNY would be indeed an iron rice bowl and bring power generation and political power in direct correlation until the externalities of generating nuclear power have to be paid. We all know, that paying for these externalities is even beyond the political horizon of the CCP.

Visionary Aldous Huxley might have seen this future when he wrote in 1963 in The Politics of Ecology the very following: Some day, let us hope, rulers and ruled will break out of the cultural prison [of lust for power] in which they are now confined. Some day ... And may that day come soon! For, thanks to our rapidly advancing science and technology, we have very little time at our disposal. The river of change flows ever faster, and somewhere downstream, perhaps only a few years ahead, we shall come to the rapids, shall hear, louder and ever louder, the roaring of a cataract. It is this cataract which I hear when a mining rig is started up or the door to a mining farm opens. Every new mining rig connected to the grid and the web accelerates the destruction of the planet and ultimately accelerates our self-destruction.

Blockchain for Social Good

So, what ought we to do? What can we do? Zennon Kapron, author of Chomping at the Bitcoin, is lately a very busy and much coveted speaker. The stellar rise of Bitcoins value against the USD and the massive Chinese stakes in the game has made him one of the most sought-after guests in many events throughout the world. He provided this January an overview of blockchain applications with a positive social impact and categorized them into four groups: political, environmental, social and economic. He elaborated on a few examples and explained that there are lots of good intentions visible like Ethereum establishing itself as a substitute for government and law industry bound contracts.

He concludes that the potential applications of Blockchain for social good are varied and exciting, however it also has its limitations. Blockchain offers a powerful mechanism to incentivize truth, increase transparency, and has the potential to make various aspects of society work better, but it cannot bring about change alone. In order to bring about lasting change, a variety of strategies and regulation will be required from both governments and corporations. As with any new and developing technology, cybersecurity is of paramount importance. Blockchain promises to be decentralized and somewhat 'un-hackable', yet the technology remains untested at scale.

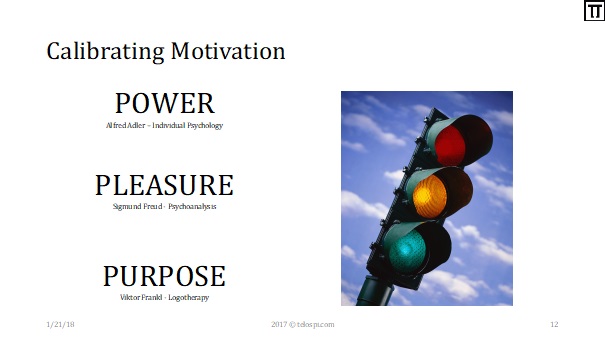

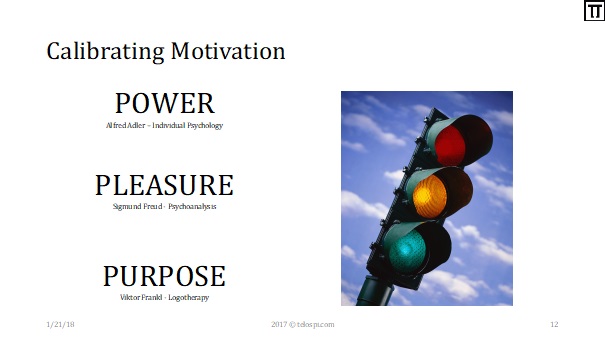

What Zennon points at goes beyond technology. It never is technology alone that brings about change, but always its interaction with human intention and our underlying value systems. Do we want technology to serve building a better, fairer, one global or many national societies? And recalling my conversation with Vasily about Alfred Adler's individual psychotherapy, are we motivated in the application of technologies by power, pleasure or purpose? It seems as if Bitcoin has for the time being confirm that Freud was wrong, because man is clearly not motivated by pleasure as he claimed, neither by purpose as Frankl said, but by power as Freud's contemporary, Alfred Adler, explained in his theory of individual psychology. Power politics - as we have seen before—don't go well with environmental protection and solidarity.

How to Build a Sustainable Civilization?

We have to ask though what it takes to build a society which motivates social cohesion and the protection of the environment. Niall Ferguson asks this question to a certain extent in Civilization—The West and the Rest. He argues in a retrospective POV that six novel complexes of institutions and associated ideas and behaviors distinguished the West from the rest and were causal for the European world dominance for the last 500 years. These killer applications are competition, science, property rights, medicine, consumer society and work ethic.

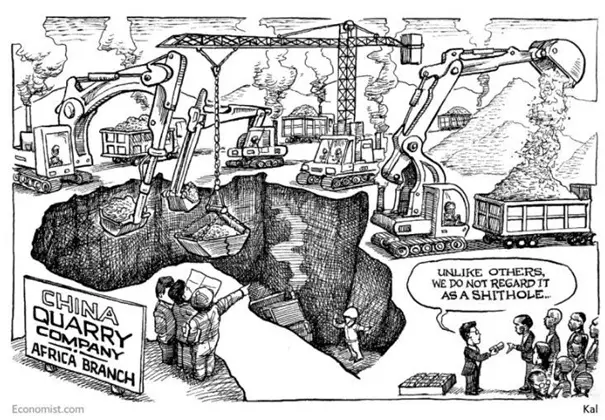

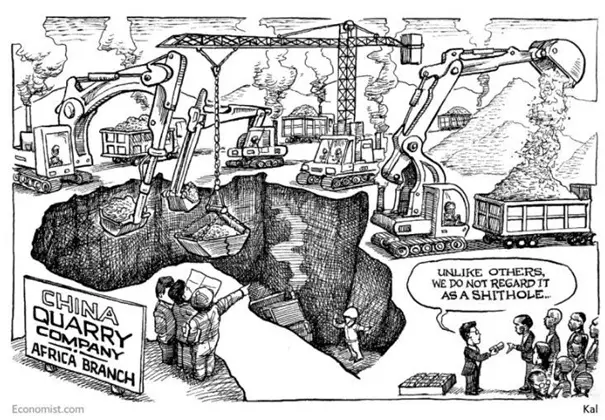

Ferguson's six killer apps are if without proper guidance by sound values what Fergusson calls them: killer apps. Apps which exterminated the populations on the North and South American continents, apps which enslaved Africa and large swaths of Asia, apps which led to two world wars and holocaust. We can of course apply competition, science, property rights, medicine, consumer society and work ethic in the service of humanity, but if we lack compassionate purpose, all these apps go mad. And this is exactly, what is happening in particular in Beijing and Shenzhen, where a commercial craze for AI is driven by a political elite which is motivated by global domination and undoing what 500 years of Eurocentrism have inflicted upon the Chinese: the century of humiliation | 百年国耻.As a result the African continent has been turned by China into one large physical mine, which fuels the excavation of a vast spiritual void.

It makes therefore much more sense to talk about seven life apps instead. Let's exchange work ethic with meritocracy, eliminating nepotism and neurotic workaholics, competition with cooperation, a higher form of play, science with humor, because science is a product of curiosity and cooperation; and the mad scientist is one who has no sense of humor; lets exchange property rights with open source; the consumer society with a basic income and let's add education and compassion; then we have the apps which we will need to build a common future. Blockchain can be the technology to run these apps, but we need to flip the principles of human motivation in our economic system in order to make it a good technology, and design the proof of work on this new foundation.

The theoretical physicist Freeman Dyson once said that technology is a gift of God. After the gift of life, it is perhaps the greatest of God's gifts. It is the mother of civilizations, of arts and of sciences. Despite my sincere conviction that technology can be applied the way Dyson puts it, I would argue with him and declare compassion and kindness the greatest of God's gifts and indeed the mother of civilizations. Societies which lack compassion and kindness turned throughout history into man and beast divulging monstrosities. Our scientific and technological powers have increased to such an extent that our lack of compassion toward the planet will soon turn against ourselves.

On the Urgency of and the Opportunity for Transformation Towards an Integral Currency

Bitcoin holds a mirror into our face, no matter whether Satoshi Nakamoto designed the currency deliberately being pegged to electricity or not. Its inception and rapid proliferation accelerates our financial systems, shortens the life cycle of currencies, puts enormous pressure on both natural resources and energy generation infrastructure and shows without mercy that we have designed our societies on the basis of scarcity, ignorance, competition and greed. With an increasing number of Bitcoin users, the negative impact on our planet grows exponentially since the mechanics of the system motivate more and more people to lift themselves into a higher economic status, which in return requires more resources: impact = resources * economic status * population (i = r * e * p).

It is in under this threat of extinction that humanity can manage a turnaround and renew itself from the very core. It is by finding a common denominator in our survival that we can understand that only a transformation of our very own self towards compassion, charity and cooperation will result in abundance for all.

Video sources:

Techcashhouse: Does Bitcoin mining still pay off? January 1st Update

Gordon Gekko: Greed is Good

Desperate Housewives on Bitcoin: How does it work?

World Economic Forum: The electricity required for a single Bitcoin trade could power a house for a whole month

Sources on blockchain:

https://techcrunch.com/2017/10/16/mapping-the-blockchain-project-ecosystem/

https://www.treehugger.com/economics/forget-bitcoin-its-blockchain-might-change-everything.html

https://www.crypto-economy.net/everything-need-know-blockchain-technology/?lang=en

Sources on bitcoin and cryptocurrencies:

https://www.metalandthings.com/ - insane retailer of money making machines

https://qz.com/1174091/china-wants-an-orderly-exit-from-bitcoin-mining/

http://fortune.com/2017/09/05/china-bitcoin-blockchain-ico-ban/

https://news.bitcoin.com/close-look-haobtc-mining-farm-china/

http://hackingdistributed.com/2018/01/15/decentralization-bitcoin-ethereum/

Sources on bitcoin and energy consumption

https://qz.com/1172632/chinas-dominance-in-bitcoin-mining-under-threat-as-regulators-hit-where-it-hurts-electricity/

https://www.theverge.com/2017/12/21/16806772/bitcoin-cryptocurrency-energy-consumption-renewables-climate-change

https://thebitcoinnews.com/a-visit-to-a-bitcoin-mining-farm-in-sichuan-china-reveals-troubles-beyond-regulation/

http://www.mycountryandmypeople.org/01-blog-2133823458/captain-planet-and-the-planeteers

http://world-nuclear.org/information-library/current-and-future-generation/plans-for-new-reactors-worldwide.aspx

Sources on big data:

Susan Etlinger: What to do with all this big data? , TED@IBM

Sources on money:

|  Knut K. Wimberger helps executive management with organizational development challenges in a Far East Asian context and supports key individuals to unfold their potential. He believes in the healing force of finding one’s vocation and is driven by giving others deeper meaning in their work. He founded the Hong Kong incorporated consultancy Telos Pi in 2016 and acts as its managing partner. A public CV is available on LinkedIn.

Knut K. Wimberger helps executive management with organizational development challenges in a Far East Asian context and supports key individuals to unfold their potential. He believes in the healing force of finding one’s vocation and is driven by giving others deeper meaning in their work. He founded the Hong Kong incorporated consultancy Telos Pi in 2016 and acts as its managing partner. A public CV is available on LinkedIn.